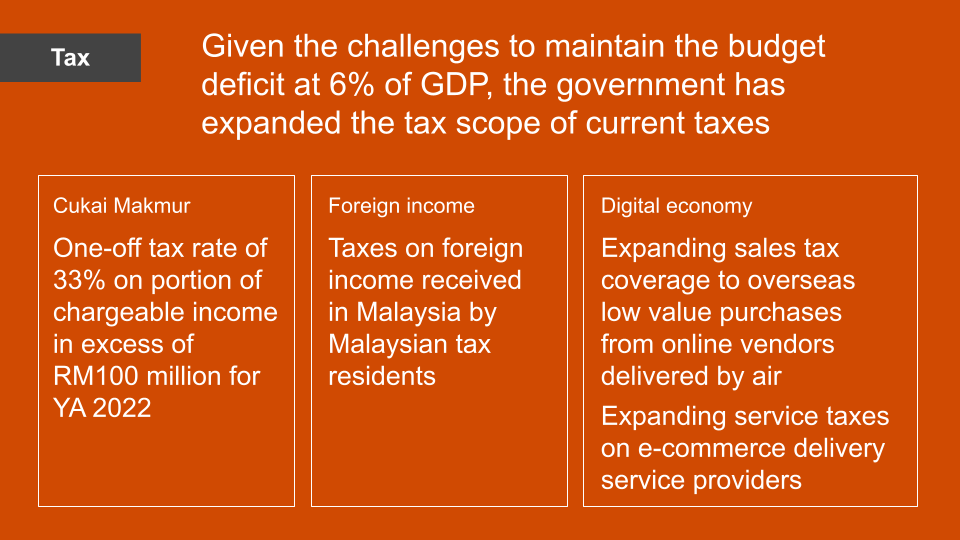

As of 1 September 2018 Malaysia has reverted to the Sales and Service Tax SST system from the Goods and Services Tax GST system. No new approvals will be granted starting 1 July 2018 for applications for an extension of the income tax exemption period or applications to add new MSC Malaysia qualifying activities.

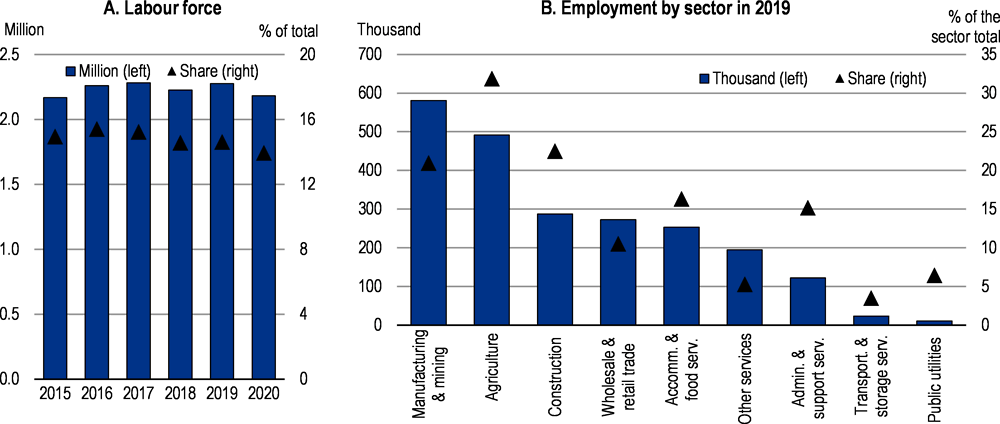

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

5 BOG have been reviewed and amended to adhere to the minimum standards under Action 5 of the Organization for Economic Cooperation and Development OECDs Base Erosion and Profit Shifting BEPS Project see Tax Alert.

. What comes as a surprise to many is the 50 tax exemption on rental income received by Malaysian resident individuals. Existing company enjoying MSC Malaysia incentives. Objective The objective of this Public Ruling PR is to explain the tax treatment in respect of tax incentives in relation to the Returning Expert Programme REP to attract.

As an initiative to increase home-ownership for the nation the Prime Minister in the Budget 2018 has allocated RM22 billion to the housing development in Malaysia. No distinction on tax treatment including transaction and currency restrictions between residents and non-residents. The criteria to qualify for this tax exemption are.

TAX INCENTIVE FOR RETURNING EXPERT PROGRAMME Public Ruling No. The Malaysian Government in its Budget 2018 announced numerous tax changes including an income tax cut incentives for women to return to work and tax relief for property investors and venture capital firms. Incentives that comply with FHTPs requirement must be gazetted by 31st December 2018.

Malaysia Tax 11 July 2018 Tax Espresso Special Alert Changes in MSC Malaysia Tax Incentive following Malaysias commitment in implementing international tax standards The Ministry of Finance has recently reiterated its commitment in adhering to the OECD taxation initiatives. No new approvals for MSC applications will be granted starting 1 July 2018. The 2018 Budget is intended to improve the standard of living of all Malaysians and took into consideration the global economic performance and synchronised economic growth said Mohamad Azizal Abd Aziz Principal Assistant Secretary Incentive Section Tax Division Ministry of Finance Malaysia when kicking off the opening session at.

12 rows Nonresident individuals are taxed at a flat rate of 28. Jan 29 2018. Goods Services Tax GST Updates 31.

In addition this study is. Although there is similar research done these years this study focuses on different determinants as well as on tax incentives. As highlighted in earlier tax alerts the financial incentives under the Multimedia Super Corridor MSC Malaysia Bill of Guarantee No.

2 May 2018 1. Malaysia joined the OECD Inclusive Framework on Base Erosion and Profit Shifting. Recent developments Following the review the Government has recently issued four MSC Malaysia-related regulation and gazette orders collectively referred to as the Orders as follows.

This study is important to study as the problem of tax non-compliance are still existing and affecting the overall federal revenue. Last reviewed - 13 June 2022. Tax incentives can be granted through income exemption or by way of allowances.

Malaysia has undertaken a review of its tax incentives and excluded royalties and intellectual property income from its tax incentives in line with the requirements of BEPS Action 5 Counter Harmful Tax Practices. Where incentives are given by way of allowances any unutilised allowances may be carried forward indefinitely to be. Malaysia has a wide variety of incentives covering the major industry sectors.

Tax Practices FHTP recommendations in relation to MSC Malaysia tax incentive were published in our Special Alert dated 11 July 2018. Only RD expenditures incurred in Malaysia are eligible for Income tax exemption. Corporate - Tax credits and incentives.

The law governing the imposition of income tax is the Income Tax Act 1967 ITA while the SST is Governed under the. Malaysia government imposed an income tax on financial income generated by all entities within their jurisdiction. Ii the tax incentives needed to survive among SMEs in Malaysia during the COVID-19 period.

For unutilised PS losses accumulated as at YA 2018 where the incentive has already expired these losses can be carried forward for another 7 YAs until YA 2025. 22018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. To increase the disposable.

By law individuals and corporations are required to file an income tax return every year to determine whether they owe any taxes or are eligible for a tax refund which you can refer more at wwwhasilgovmy.

Assessing The Impact Of Sugar Tax In Malaysia Euromonitor Com

Malaysia Personal Income Tax Guide 2021 Ya 2020

Tax Incentives For Green Technology In Malaysia Gita Gite Project

Why It Matters In Paying Taxes Doing Business World Bank Group

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Tax In Malaysia Malaysia Tax Guide Hsbc Expat

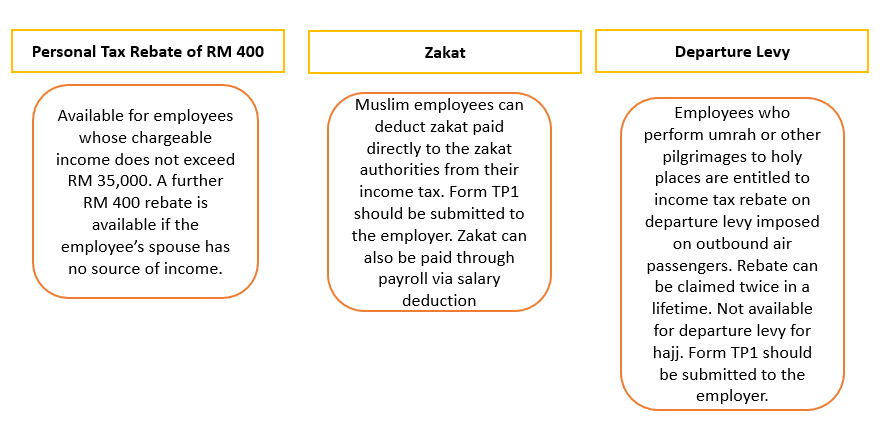

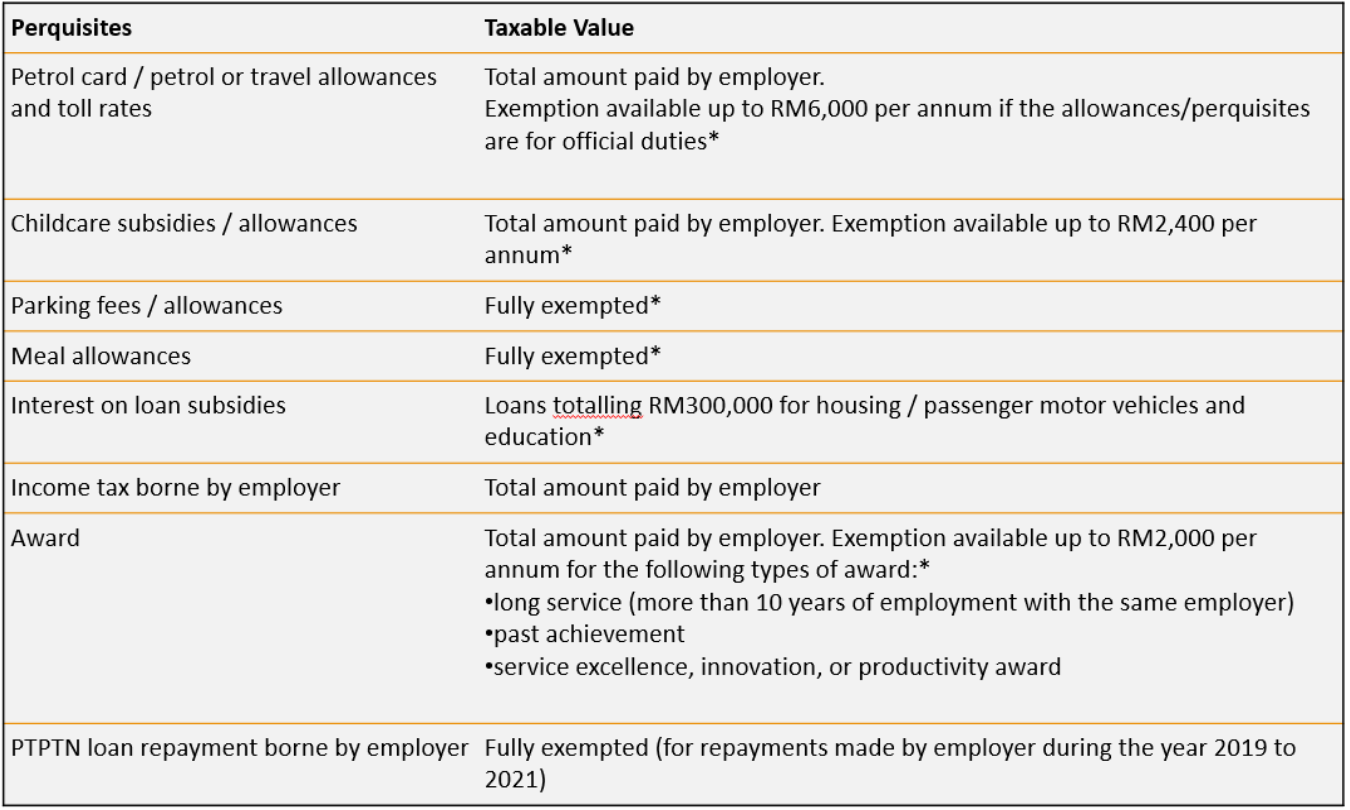

Everything You Need To Know About Running Payroll In Malaysia

Assessing The Impact Of Sugar Tax In Malaysia Euromonitor Com

Everything You Need To Know About Running Payroll In Malaysia

Malaysia Resources And Power Britannica

Everything You Need To Know About Running Payroll In Malaysia

Why It Matters In Paying Taxes Doing Business World Bank Group

Updated Guide On Donations And Gifts Tax Deductions

6 Reason To Invest In Malaysia Stock Exchange Financial Management Stock Exchange Investing

Malaysian Tax Issues For Expats Activpayroll

19 Initiatives That Ll Benefit The Youths Under Malaysia S Budget 2022 Social Good

A Proposal For Carbon Price And Rebate Cpr In Malaysia Penang Institute

19 Initiatives That Ll Benefit The Youths Under Malaysia S Budget 2022 Social Good